tax benefit rule calculation

If using the cents-per-mile rule to value the benefit for the employee you multiply the number of miles the employee uses the vehicle for personal use by the IRS. You can calculate your potential returns using the VPF.

How To Calculate Earned Income For The Lookback Rule Get It Back

When the couple paid the excess refund 400 to.

. What form of tax will be applied once the bond is sold. While making a long-term investment it is advised to calculate the final returns to plan further wisely. NPS login calculator interest rate steps to download ePRAN.

The business mileage rate for 2022 is 585 cents per mile. A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit. Individual Income Tax Return or Form 1040-SR US.

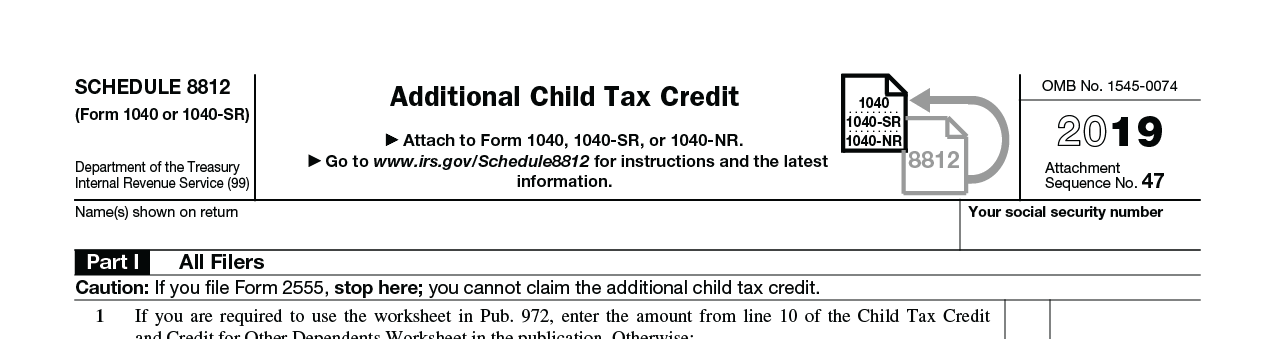

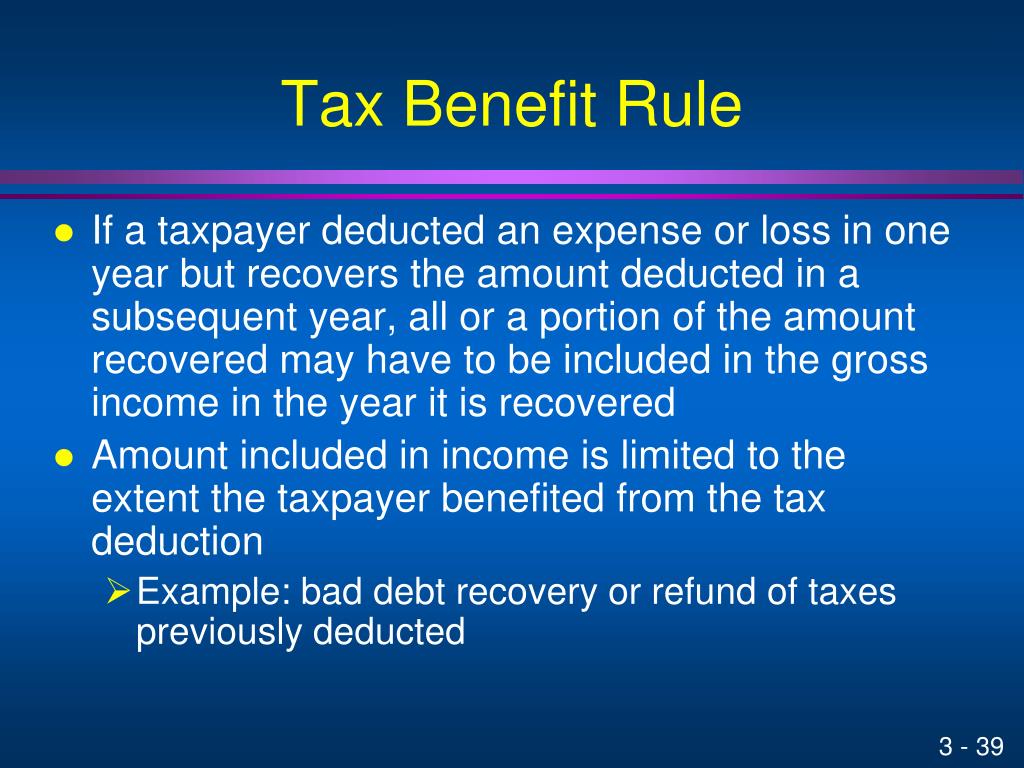

If the full 5000 refund were disallowed their limited tax deduction under the TCJA would drop to 9000 from 10000 resulting in an increase in taxable income and an. But from 1st January 2022 they can claim nil provisional ITC. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a.

You are given a 15-year bond with a face value of 1500 and it matures in six years. The tax benefit rule is a feature of the United States tax system. Of state income tax in 2018 Cs state and local tax deduction would have been reduced from 10000 to 9500 and as a result Cs itemized deductions would have been reduced from.

Its main principle is that if a taxpayer recovers a sum of money that should have been paid in the past they must. You may use this rate to reimburse an employee for business use of a personal vehicle and under certain. Example with Calculation.

The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be. The tax credit reduces your tax bill by that same 1000. This is done by calculating the present value of the after tax cash flows attributable to the asset where the cash flows do not reflect amortization charges in the tax.

If the couple received a state tax refund of 500 in the current year the taxpayer will include all of the refund in their current year income. Therefore the taxpayer did not receive a tax benefit and 14323 of the 40000 is not subject to tax in 2001. The TAB is calculated by using a two-step procedure.

However if total tax increases by any amount a tax benefit was received. File a joint return and you and your spouse have a combined income that is between 32000 and 44000 you may. So if you owed 1500 in taxes and then took a 1000 credit your tax bill would be 500 1500 - 1000.

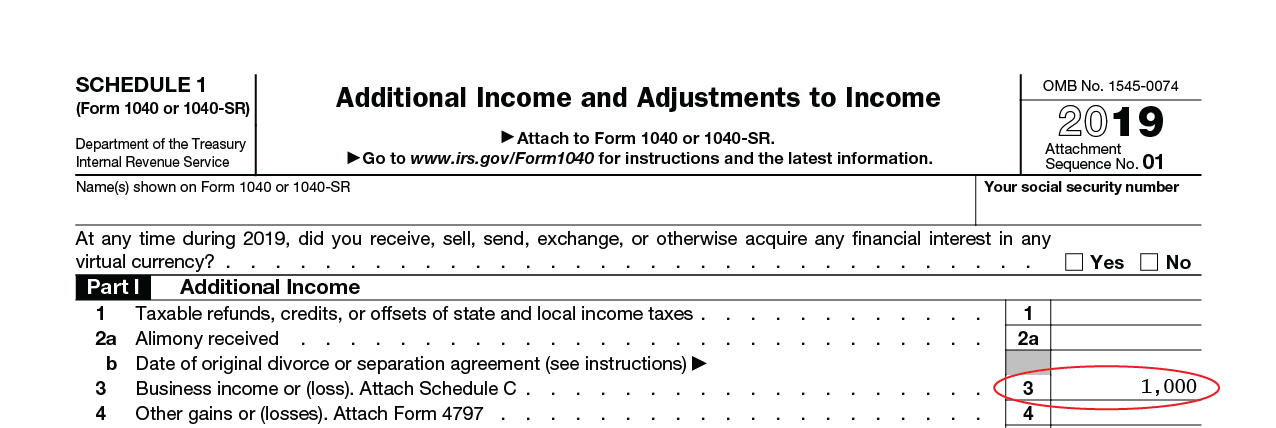

The taxable refund for 2001 should be 25677 40000 14323. VPF calculator. The National Pension Scheme NPS has emerged as a good option for someone seeking a low-cost.

Calculation of net profit of self-employed earners. Year 1 interest paid year 1 property tax paid- if marked as deductible year 1 MI paid- if. Tax benefits include tax credits tax deductions and tax deferrals.

If inclusion of the refund does not change the total tax the refund should not be included in income. The tax benefit shown in the summary section is defined by the following equation. More than 34000 up to 85 percent of your benefits may be taxable.

However under the tax benefit rule the taxpayer must only include the refund up to the amount by which the deduction.

How Much To Set Aside For Small Business Taxes Bench Accounting

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Ppt Determining Gross Income Powerpoint Presentation Free Download Id 1641304

Tax Benefit Rule Income Tax Course Cpa Exam Regulation Youtube

Rsu Taxes Explained 4 Tax Strategies For 2022

What Is The R D Tax Credit And Could Your Company Qualify

How To Deduct Stock Losses From Your Taxes Bankrate

Self Employed Health Insurance Deduction Healthinsurance Org

/AGI-FINAL-6a232c512a9d4606a0c8a29fa57dbb59.png)

What Is Adjusted Gross Income Agi

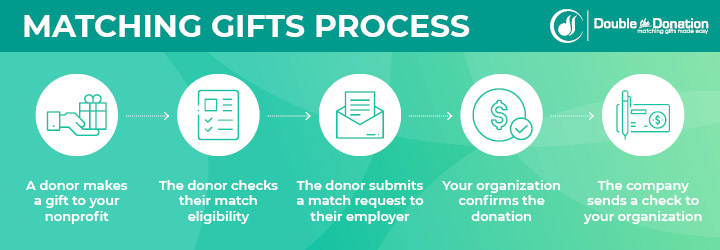

Tax Benefits Of Corporate Matching Gifts The Basics

How To Calculate Earned Income For The Lookback Rule Get It Back

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

What Is Taxable Income With Examples Thestreet

Taxable Income Formula Examples How To Calculate Taxable Income

Coronavirus Tax Relief Covid 19 Tax Resources Tax Foundation

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

Tax Shield Formula How To Calculate Tax Shield With Example

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure