has capital gains tax increase in 2021

If capital losses exceed capital gains you may be able to use the loss to offset up to 3000 of other income. In addition capital gains tax rates are lower than those for regular income.

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

The federal tax rates for 2021 can be found on the Canada Revenue Agency CRA website.

. These income thresholds increase to 459750 for single taxpayers and to 517200 for married couples filing joint returns in tax year 2022. Avoiding a capital gains tax on your primary residence You can sell your primary residence and avoid paying capital gains taxes on the first 250000 if your tax-filing status is single and up to. A capital gain refers to the increase in a capital assets value and is considered to be realized.

The capital gains tax is one of the main taxes you will need to pay after obtaining a profit from an economic transaction. Filing Status 0 15 20. Short-term capital gains tax rates are generally higher than long-term capital gains tax rates.

You need to feed your property sale purchase date along with values. Any increase in the asset value afterwards wont include the tax reduction and will be taxed at the normal rate. It calculates both Long Term and Short Term capital gains and associated taxes.

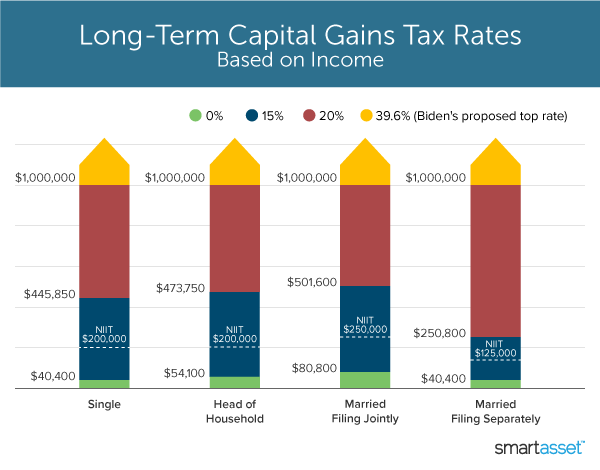

Since your ordinary income tax bracket is 22 by taking advantage of the lower capital gains tax rates you saved 70 in taxes 150 versus 220 on a 1000 capital gain. A proposed House Ways and Means bill suggests raising capital gains tax rates to a maximum of 28 percent still lower. The federal government taxes long-term capital gains at the rates of 0 15 and 20.

However theyll pay 15 percent on capital gains if their income is. There is option to include cost of repairsimprovement that you might. In the United States of America individuals and corporations pay US.

Once again it will be a good newsbad news period. What is the capital gains tax rate in Canada. Up to 40400.

In 2021 and 2022 the capital gains tax rates are. When including the net investment income tax the top federal rate on capital gains would be 434 percentRates would be even higher in many US. 50000 - 20000 30000 long-term capital gains.

Only single people who made more than 445850 and married couples who earned more than 501600 or more in 2021 will pay the highest capital gains tax rate. The amount of Capital Gains Tax collected by the government has shot up by more than 5bn in the past two years according to official figures from HMRC. Long-term capital gains tax and short-term capital gains tax capital gains tax triggers how each is calculated how to cut your tax bill.

Investors must pay capital gains taxes on the income they make as a profit from selling investments or assets. Most actively managed stock funds have enjoyed strong absolute gains in 2021 but. Capital gains season approaches for mutual fund investors.

2021 at 1236 pm. Ad Compare Your 2022 Tax Bracket vs. Discover Helpful Information and Resources on Taxes From AARP.

In simple terms a capital gain is an increase in the value of an investment such as stocks or shares in a mutual fund or exchange traded fund or real estate holding from the original purchase price. Contrary to popular belief capital gains are not taxed at a set rate of 50 nor are they taxed in their entirety at your marginal tax rate. June 6 2022 We have compiled an Excel based Capital gains calculator for Property based on new 2001 series CII Cost Inflation Index.

Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold. For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to 396 percent for higher earners.

For example if you bought a property in January 2021 and sold it in May 2021 which is less than 1 year you will have to pay short-term capital gains tax on any. Long-Term Capital Gains Tax Rates for 2021. What is the capital gains tax rate in Canada.

Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and the amount of time the investment was held. Rising from 98bn in 201920 to 14. This is done to encourage investors to hold investments for a longer period of time.

If you have more than 3000 in excess capital losses the amount over 3000 can be carried forward to future years to offset capital gains or income in those years. Your 2021 Tax Bracket to See Whats Been Adjusted.

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Can Capital Gains Push Me Into A Higher Tax Bracket

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What You Need To Know About Capital Gains Tax

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

What S In Biden S Capital Gains Tax Plan Smartasset

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How High Are Capital Gains Taxes In Your State Tax Foundation

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)